After twenty-two years in the US pharmaceutical industry, I was laid off. I remember that day very well— a bleak winter morning rendered bleaker by the verdict, a devastating blow. No job, no regular pay checks, no routine or fixed schedule in my life. How will I manage? It was disorienting.

What should I do now, I pondered. Get another job? With my background and experience that would not be too difficult. But, do I want to? Same old, same old did not appeal to me. Why not try something different. But what? Decisions, decisions!

What if I retired? Could I afford to? I had meticulously planned for it by carefully saving and investing since my first job. I assessed my finances. That planning and foresight had finally borne fruit. I had enough for our needs. No need to toil day after day to earn my daily bread. I realized I was free, free to do what I want when I want. I wasn’t answerable to anyone. It was a liberating moment.

I was fifty-eight. I could now enjoy life on my own terms. And the fateful layoff kick-started it all. A seeming disaster turned into the proverbial blessing in disguise. Eleven years have gone by since that bleak winter morning. For me, retirement has been wonderful, a blast. I am busy working, not because I have to but because I want to, doing things I love— traveling, writing and giving Travel-Talks on my adventures and experiences in other lands. I ceremoniously got rid of my alarm clock. No need for artificial clocks any more. I let my circadian clock guide my daily routine—taking a walk, listening to bird-song, the smell of roses, a good book, a glass of wine, the sunset.

Retirement was not an instantaneous process. It needed a period of adjustment. A speeding car does not stop immediately when you hit the brakes. It gradually slows before stopping. Similarly, I had developed a deeply ingrained habit of working over many years. So much free time felt awkward at first. I wondered—is this the right decision, should I look for work, is there more to aspire to? But after some months, those thoughts subsided. I remember one particular snowy morning when I woke up and realized that I did not have to get up and drive over treacherous, icy roads to work. What a blessing! I snuggled back into the sheets for more shut-eye. Life was good.

I had observed my father slip happily and effortlessly into retirement. He would sit on the porch with a beatific expression on his face, read the paper or watch the world go by. That was the impression I retained of retirement— happiness, tranquility and beatitude. Perhaps, throughout my busy, eventful life across three continents, that is what I had unconsciously aspired to.

I have often been asked how I had planned for retirement. There are four parts to the story: Learn, Work, Invest, Retire. It starts decades earlier.

My schooling was at Ramakrishna Mission Vidyalaya, Narendrapur, a residential school with a rigorous academic curriculum and a strict, semi-monastic life. Good habits are emphasized; frugality, discipline, independence, courage and understanding. Plus, a well-rounded education, crucial for personal development and earning a living, all useful assets in life.

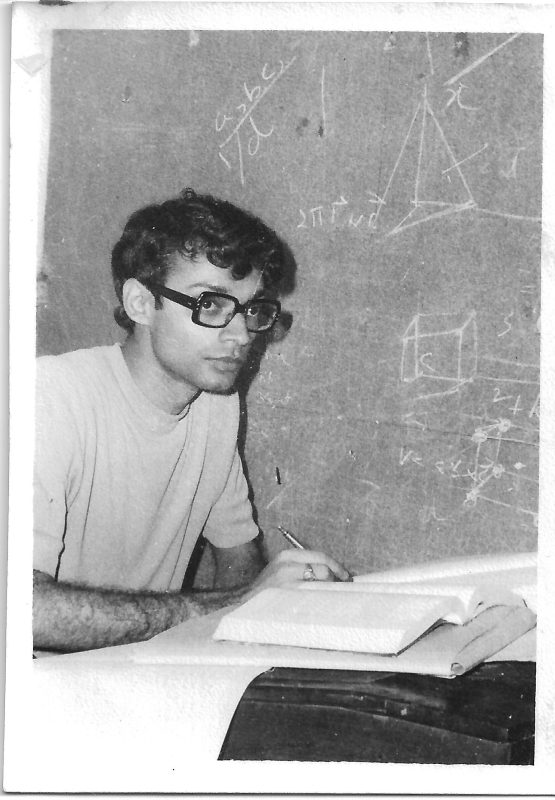

After my B.Sc. (St. Xavier’s College) and M.Sc. (Calcutta University), I taught science to tribal high school students in Arunachal Pradesh. We were surrounded by dense jungle teeming with wildlife that then included tigers, leopards and elephants.

Shortly after that adventure, I came to the University of Delaware to do my Ph. D in physics. Within weeks I had to switch fields. I chose biology, completed my Ph.D., and after a post-doctoral stint joined the pharmaceutical industry.

In school I learned how to make do with little. It enabled me to live within my means. That, in turn, enabled me to save, even when I was a penurious, married Ph.D. student. My stipend was about $10,000 per annum. With that I supported my wife and myself. It wasn’t difficult—we had a university owned, one-bedroom, married-student apartment and a stick-shift Datsun. We traveled, ate well (food was cheap and my wife is an excellent cook), were newly married and had fun. Lots of it. Looking back, those were some of the happiest years— no worries, responsibilities or mortgages. We also saved enough for two tickets to Strasbourg, France (via Kolkata), where I did my post-doc in the lab of Prof. Pierre Chambon, an expert on gene transcription. My wife, whom I had first met in a German class, and I, speak French and German. We therefore had no language problems in Europe. There we developed a love for cheeses, breads and wines, especially Riesling and Gewürztraminer, the two famous wines of Alsace.

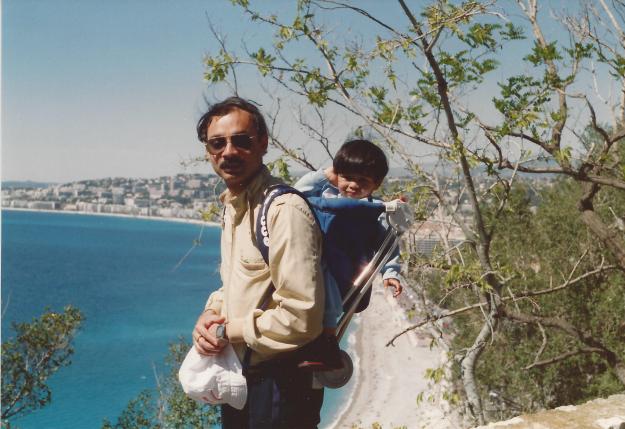

In life, planning is important. When I was a Ph.D. student, we decided not to have children. We could not afford to. As a post-doctoral trainee in France, which has an excellent health care system that covered us, we decided to start a family. Our son was born within a year. Mother and son stayed in the hospital for a week and received excellent care. I did not have to pay a single franc out of pocket. We were impressed.

Back at home, with her baby in her arms, my wife decided to become a full-time stay-at-home mom and wife, a homemaker. That was her decision. I, therefore, by default, became the sole breadwinner. Expectations had to be reset. We decided to limit ourselves to one child. She took care of the house and all it entails. I worked and took care of the finances. The old-fashioned spear and distaff, but it has worked for us, so far.

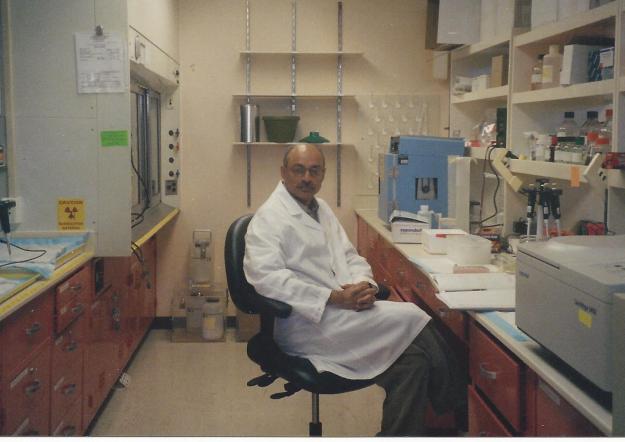

After three wonderful years in France, we returned to the US and I began my professional life as a scientist in the Biotech and Pharmaceutical Industry. I worked in three different companies; Ligand Pharmaceuticals (San Diego), DuPont Pharmaceuticals (Delaware), and Bristol-Myers Squibb (New Jersey). Over time, I did bench science, published papers, filed patents, attended meetings, led discovery teams, gave talks and chaired conferences. I learned to play golf at Torrey Pines (I still remember the unique scent of the pine and eucalyptus trees) and ski in Whistler. Life was exhilarating.

I also taught myself the fundamentals of investing from the financial section of the local papers and websites. I started contributing to my 401k plan and maximized contributions as soon as I could. I understood the importance of starting early, contributing regularly and the value of compounded returns over time. I saw no reason to hire expensive financial advisors. Index funds are comparable to and sometimes outperform actively managed funds in the long term. I made them a large part of my portfolio. The financial crisis of 2007-2008 was a valuable lesson. It showed that if you have the wherewithal to ride out a market downturn, you will do well on the rebound. For that, a cash cushion is necessary. I now have a well-diversified portfolio that I manage, which, along with our Social Security payments and an annuity, should take care of our financial needs. I have made it as worry-proof as possible and this gives me the peace of mind to enjoy retirement.

Finances are crucial but not the only issue for retirement. One also has to invest in health and family.

A healthy body is the vehicle with which to enjoy life and retirement. No point in being a billionaire restricted to a wheel chair. We are a product of nature and nurture—genes and environment. We have no control over the genes we inherit. But we have control over how we live, work, eat, exercise, relax and a whole lot more. Modern life and work are stressful, not conducive to good health, one reason I stopped working early. We eat delicious and healthy home-cooked meals in moderation. That’s the key—moderation. My exercise routine involves walking in the neighborhood and parks with some weights and stretches at home. I used to smoke but gave it up years ago. I consider myself reasonably healthy for my age—no serious issues except two replaced knees.

A close-knit family is a blessing. Who else to enjoy life with! My wife and I have been friends since our college days and now married for thirty-nine years. We were separated for five years while I was doing my Ph.D. in the US and she was in India. I went back, married, and, since then, have always been together. Our son did his Ph.D. at Weil-Cornell Medical College in New York and then switched to the financial services industry, a bold but lucrative step. He is a fine young man, independent, yet close to us.

In retirement there is plenty of free time. But, if the mind is not productively engaged, it can be dangerous. I keep it active and engaged. I pondered—what would I want to do if I had the time and money? Pursue my hobbies— reading, writing and traveling.

I started writing small articles on my travels. They were published in local newspapers and websites. I traveled to Nepal, saw the rising sun bathe Annapurna in liquid gold and on an elephant, tracked and photographed a one-horned rhino in Chitwan National Park. I visited the distant Andaman Islands, a godforsaken penal colony under British rule, and jet skied in the warm turquoise waters.

I started my website and blog ranjanmukherjee.com. Publishing is now easy— write, edit, and when satisfied, click ‘publish’. Done. It’s online. These activities keep my happily engaged. I don’t have a boss except my wife who still gives me four delicious meals a day, the fourth being afternoon tea. And I take a short nap at noon. It is extremely refreshing.

I was invited to join a group of writers with the goal of translating selected Bengali short stories into English. These were published as “Treasures from Bengal, An Anthology”. I had never translated before, a new experience.

Unexpectedly, I received an invitation to speak at a scientific conference in China. I accepted. They must have liked what I said and how I said it for they invited me again, to write a book on their research program. I agreed, on condition that I have time to do some sightseeing. On that trip, I visited Beijing where I saw the Great Wall and had an excellent Beijing Duck in a famous restaurant just south of Tiananmen Square; Shanghai, where I went to the top of the Oriental Pearl Tower; Zhuhai, where I saw the long bridge connecting the mainland to Hong Kong and zipped to Hangzhou and Wenzhou by bullet train.

After the COVID-19 pandemic subsided, my son and I visited the national parks of the southwest and the sites of ancient Mexican civilizations (Teotihuacán to Chichén Itzá). In June we traveled to the Canadian Rockies.

I give Travel-Talks at libraries and retirement homes. This is my new gig. These slide and video presentations are lively discussions where I get a lot of questions. People are curious to learn about life and culture in other countries and this understanding brings people closer. Hopefully, I am able to help a little.

Retirement may require a mental adjustment. At this point we don’t have an exalted job title, the corner office, a corporate jet and all the perks. Do we need them? A Zen attitude helps. Money is necessary, up to a point. Beyond that, the constant need to work and earn more leads to restlessness.

I found this quote from Einstein enlightening, “A calm and modest life brings more happiness than the pursuit of success combined with constant restlessness.”

Relax. Let go. Be free.

Enjoy life and retirement.

More on planning for and enjoying retirement can be had in the book titled “Living Free, Living Well: My Life as a Zen Bon Vivant” available on Amazon.com. The cover picture is shown below.